2018 tax refund calculator

The Colorado State Tax calculator is updated to include. IR-2018-36 February 28 2018.

Do You Need To File Taxes How Much Money You Have To Make Money

WASHINGTON The Internal Revenue Service today released an updated Withholding Calculator on IRSgov and a new version of Form W-4 to help taxpayers check their 2018 tax withholding following passage of the Tax Cuts and Jobs Act in December.

. This is an optional tax refund-related loan from MetaBank NA. However as per Taxation and Other Laws Ordinance 2020 any delay in payment of tax which is due for payment from 20-03-2020 to 29-06-2020 shall attract interest at the lower rate of 075 for every month or part thereof if same is paid after the due date but on or before 30-06-2020. A tax refund or tax rebate is a payment to the taxpayer when the taxpayer pays more tax than they owe.

Judy had remained. 202223 Tax Refund Calculator. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

You have nonresident alien status. Youll get a rough estimate of how much youll get back or what youll owe. According to the Internal Revenue Service 77 of.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. 2022 CWB amounts are based on 2021 amounts indexed for inflation. This calculator can be used to calculate long term capital gains LTCG and the corresponding LTCG tax liability for listed shares and units of equity oriented mutual fund schemes sold between 142018 and 3132019 both dates inclusive.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Estimate your tax refund using TaxActs free tax calculator. Just answer a few simple questions about your life income and expenses and our free tax calculator will give you an idea if you should expect a refund and how much or if youll owe.

How You Can Affect Your New York Paycheck. Estimate your tax withholding with the new Form W-4P. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

Here are over 10 more 2019 Tax Calculator tools that give you direct answers on your personal tax questions. 202223 Colorado State Tax Refund Calculator. Purchase dates can be entered only up to 3132018.

The IRS urges taxpayers to use these tools to make sure they have the right. Looking for a quick snapshot tax illustration and example of how to calculate your. After July 15 2023 you will no longer be able to claim your 2019 Tax Refund through your Tax Return.

This calculator is updated with rates and information for your 2021 taxes which youll file in 2022. Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. But this calculator can help you work out how much income tax youll need to pay in the 2018-19 tax year.

On January 10 2020 Dick became a nonresident alien. DisclaimerThe above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all circumstances. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

If your tax filing status is single head of household or married filing separate call the IRS Refund Hotline 1-800-829-1954 and report your refund as lost via the automated system or while. See how income withholdings deductions and credits impact your tax refund or balance due. Loans are offered in amounts of 250 500 750 1250 or 3500.

202223 Arizona State Tax Refund Calculator. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Calculate your total tax due using the AZ tax calculator update to include the 202223 tax brackets.

This includes alternative minimum tax long-term capital gains or qualified dividends. This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens.

Did you know you can only file electronically when you are. By country United States. Tax filing season always begins in September after the tax year finishes 2023 Mar 2022 - Feb 2023 2022 Mar 2021 - Feb 2022 2021 Mar 2020 - Feb 2021 2020 Mar 2019 - Feb 2020 Did you work for an employer or receive an annuity from a fund.

Your tax situation is complex. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. Calculations are based on rates known as of June 17 2022 including federal and provincialterritorial tax changes known at this time.

Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund. If you find yourself always paying a big tax bill in April. Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward.

Refund requests for tax withheld and reported on Form 1042-S Form 8288-A or Form 8805 may require additional time for processing. To access Withholding Tax Calculator click here. This is an optional tax refund-related loan from MetaBank NA.

A financial advisor in New York can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future. Refunds of certain withholding tax delayed.

Calculate your total tax due using the CO tax calculator update to include the 202223 tax brackets. The Cumulative Average Method in computing withholding taxes where the total supplementary compensation is equal or greater than the total regular compensation cannot be accommodated in the calculator. My taxable income is 144000 and Ive paid.

Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. They chose to treat Judy as a resident alien and filed joint 2018 and 2019 income tax returns. Simply enter what you earned during the 2018-19 tax year and well do the hard work for you showing you exactly how much income tax and National Insurance youll pay this tax year as well as how much of your salary youll take home.

If you did not receive this payment you can claim the money via the Recovery Rebate Credit on your 2020 Tax Return which was due on October 15 2021. For the 2017 tax year the average refund was 2035 and for 2018 it was 8 less at 1865. The above calculator provides for interest calculation as per Income-tax Act.

The tax calculator below allows you to estimate your share of the first Coronavirus Crisis related stimulus payments issued to most American taxpayers or residents. 2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and provincial factors. It is not your tax refund.

See Publication 505 Tax Withholding and Estimated Tax. It is not your tax refund. Deduct the amount of tax paid from the tax calculation to provide an example of your 202223 tax refund.

To estimate the impact of the TRAIN Law on your compensation income click here. So make sure to file your 2019 Tax Return as soon as possible. The Arizona State Tax calculator is updated to include.

Loans are offered in amounts of 250 500 750 1250 or 3500. Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount.

Demystifying Irc Section 965 Math The Cpa Journal

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax Day 2019 H R Block S Tax Calculator Estimates 2018 Tax Refund

Tax Calculator Clearance 59 Off Www Wtashows Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Day 2019 H R Block S Tax Calculator Estimates 2018 Tax Refund

Tax Return Calculator Flash Sales 56 Off Www Wtashows Com

The New 1040 Form For 2018 H R Block

See Your Refund Before Filing With A Tax Refund Estimator

Tax Calculator Estimate Your Income Tax For 2022 Free

The New 1040 Form For 2018 H R Block

Tax Return Calculator Flash Sales 56 Off Www Wtashows Com

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax Fy 2018 19 Examples Slab Rates Tax Rebate Ay 2019 20 Fincalc Tv Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

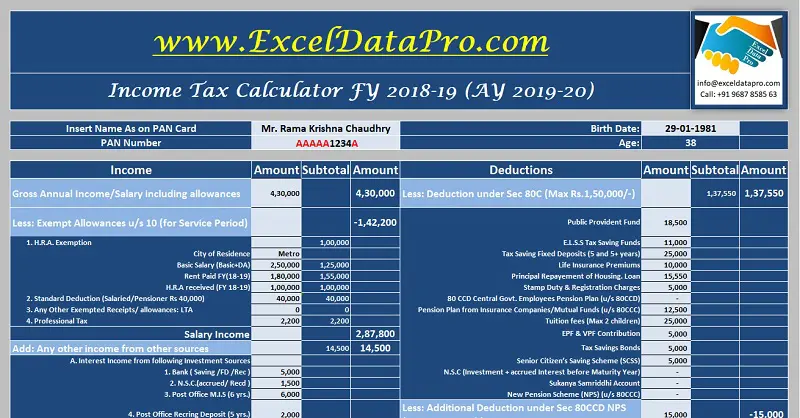

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Tax Return Calculator Flash Sales 56 Off Www Wtashows Com